Federal Healthcare Workforce Policy Report 2026: The End of Grad PLUS & The Scope of Practice Crisis

Disclaimer: This article is for educational purposes only and does not constitute legal, financial, or clinical advice. Always verify current federal regulations and consult a financial aid professional.

Why Am I Talking About Workforce Policy?

We usually focus on clinical data, but the 2025 legislative shifts are structural threats to the profession. I've spent the last year watching the "One Big Beautiful Bill Act" (OBBBA) move through reconciliation, hoping the language regarding "Professional Degrees" would soften. It didn't. As of July 4, 2025, the financial architecture of American healthcare education has changed. For my colleagues in nursing and pharmacy informatics, and for the residents we train, the math of becoming a provider just got significantly harder.

The New Loan Hierarchy (2026)

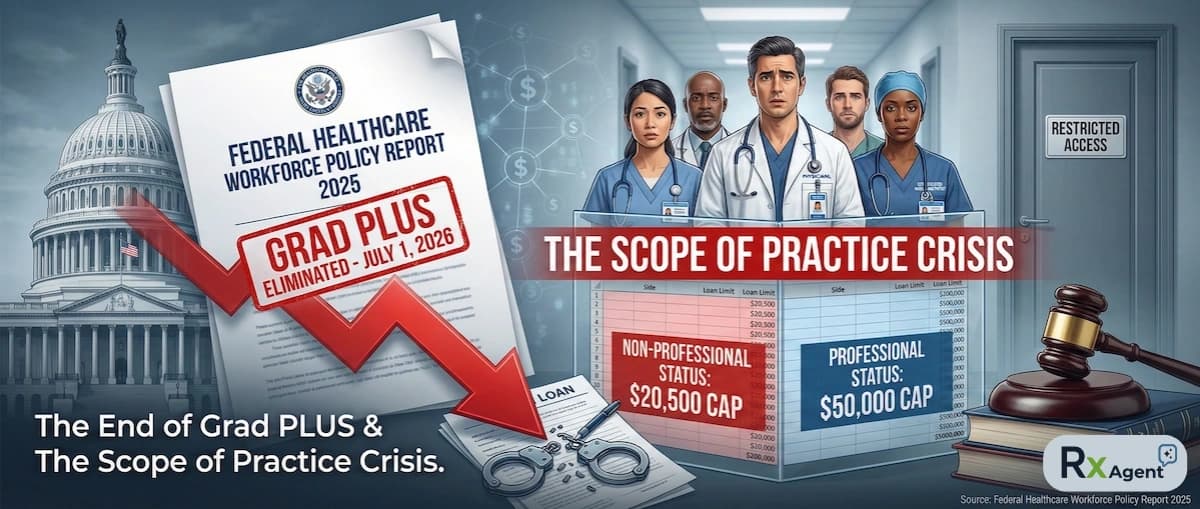

Figure: The bifurcation of borrowing power effective July 1, 2026.

A Quick Heads-Up for Institutional Leaders and Program Directors

If the table above made you think, "How are we going to maintain enrollment numbers?" — you’re seeing the cliff coming.

Navigating the new definitions of "Professional Degree," managing "Legacy Borrower" status for your cohorts, and tracking state-level scope of practice pivots is becoming a compliance nightmare.

Rx Agent helps you stay ahead. It automatically:

- Tracks legislative updates like the "Lawler Bill" in real time

- Monitors changes to "Professional Degree" CIP code classifications

- Flags state-level scope of practice expansions that conflict with federal funding

- Alerts you to workforce supply shifts in your region

I joined the waitlist because I need to know if the regulatory landscape is shifting under my feet before the academic year starts.

👉 Get early access here: https://www.rxagent.co/

The "One Big Beautiful Bill Act" (OBBBA): A Statutory Shift

The philosophy has shifted from "Education as a Public Good" to "Skin in the Game." The OBBBA, passed via budget reconciliation, is built on the idea that easy credit (Grad PLUS) caused tuition inflation. The administration's solution? Turn off the tap. Effective July 1, 2026, the Grad PLUS loan program is eliminated for new borrowers.

This removes the safety valve. Previously, if tuition and living expenses exceeded the standard loan limits, Grad PLUS covered the difference. Now, that difference is a chasm.

The "Professional Degree" Exclusion

This is where the policy becomes a de facto scope of practice restriction. The Department of Education's "RISE Committee" had to define which degrees got the new, higher $50,000 annual loan cap ("Professional") and which got the lower $20,500 cap ("Graduate").

Despite the critical role of Advanced Practice Providers (APPs), the committee excluded them based on technicalities regarding CIP codes and program duration.

Who is "Professional" ($50k Cap)?

- Medicine (MD/DO)

- Dentistry (DDS)

- Pharmacy (PharmD)

- Chiropractic (DC)

- Law (JD)

Who is "Non-Professional" ($20.5k Cap)?

- Nurse Practitioners (NP)

- Physician Associates (PA)

- Certified Registered Nurse Anesthetists (CRNA)

The symbolism is stark: A Chiropractor is federally recognized as a "Professional" for funding purposes, while a CRNA managing anesthesia in an OR is not.

The Funding Gap: A Real-World Scenario

Let’s look at the math for a CRNA student starting in Fall 2026. Without Grad PLUS, the gap is immediate and aggressive.

- Tuition: $55,000

- Living Expenses: $25,000 (Clinical rotations prevent working)

- Total Cost: $80,000

- Federal Loan Limit: -$20,500

- The Gap: $59,500 per year

That $59,500 must now come from private loans with interest rates currently hovering around 9-12%, requiring credit checks and co-signers. This effectively privatizes the risk of workforce development and imposes a "wealth test" on entry.

The Project 2025 Connection & DPC Paradox

The policy creates a strange collision between supply and demand. The OBBBA includes a provision effective Jan 1, 2026, allowing Health Savings Accounts (HSAs) to pay for Direct Primary Care (DPC) memberships. This aligns with the Project 2025 goal of moving away from insurance-based care.

- The Demand: Tax-advantaged DPC memberships will drive patients to these practices.

- The Supply: DPC practices rely heavily on NPs and PAs to keep costs low.

- The Conflict: The government is stimulating demand for DPC while simultaneously cutting off the supply of the workforce needed to run it.

State and Legislative Responses

Not everyone is taking this lying down. We are seeing a fracture within the GOP. Congressman Mike Lawler (R-NY) introduced the Professional Student Degree Act (H.R. 5209) in December 2025 to force the inclusion of nursing and PAs in the "Professional" definition.

Meanwhile, states like Pennsylvania and Illinois are rushing to fill the gap with state-level loan repayment programs, trying to prevent a provider exodus.

Impact Analysis Table (Effective July 1, 2026)

| Profession | OBBBA Status | Annual Federal Cap | Estimated Private Loan Need (per yr) |

|---|---|---|---|

| Medical Doctor (MD/DO) | Professional | $50,000 | ~$10,000 |

| Pharmacist (PharmD) | Professional | $50,000 | ~$10,000 |

| Chiropractor (DC) | Professional | $50,000 | ~$10,000 |

| Nurse Practitioner (NP) | Non-Professional | $20,500 | ~$39,500 |

| Physician Associate (PA) | Non-Professional | $20,500 | ~$39,500 |

| CRNA | Non-Professional | $20,500 | ~$39,500 |

Reddit Test: What Students Are Saying

The panic is visible on r/StudentLoans and r/medicalschool. Threads from late 2025 are dominated by strategies to "lock in" Legacy Borrower status. Students are deferring acceptances or rushing applications to matriculate before July 1, 2026. One thread asked, "Is it worth taking out a private loan at 11% for NP school?" The top comment was simply: "Not unless your spouse is rich." That sentiment tracks perfectly with the report's forecast on diversity and equity.

Conclusion

The "Soft" Restriction is the Hardest to Overcome. We often worry about legal scope of practice—what we are allowed to do. But the OBBBA introduces a financial scope of practice—who can afford to do it. As we approach the July 2026 implementation, the healthcare sector faces a structural realignment that will likely result in a smaller, wealthier, and less diverse workforce.

Frequently Asked Questions

About the Author

Dr. Zade Shammout, PharmD writes about prescription medications, pharmacy laws, and healthcare compliance for prescribers and pharmacists.